Apple becomes the first trillion dollar US company

by Diego Perdomo

Steve Jobs, Steve Wozniak, and Ron Wayne would have never imagined that with the creation of the Apple I, the flagship product of Apple Computers Incorporated, came the birth of a future international Goliath and the first U.S. company to have a market capitalization of $1 trillion as of Aug. 2 and $1.103 trillion as of Sept. 4. The initially small company now dominates the rest of the technological industry, as well as American business.

As Apple continues to develop, it has surpassed the GDP of many world countries. Many tech companies like Microsoft, Amazon, Samsung, and Apple continue to make phones and computers that a majority of the general public view as a necessity. Because of the significance of their achievement, many companies begin to work more intensively on taking Apple’s place in the global market. Governments will most likely continue to introduce more regulations to prevent economic domination and people may start to speak up against a company that influences much of today’s culture.

“Based on some of the fact that there are more older, established companies that have been around for hundreds of years and they made it that quickly, as opposed to others,” said West Broward marketing teacher Tony Shaw. “But they have a product that has caught on and the American public feels as if they cannot live without it.”

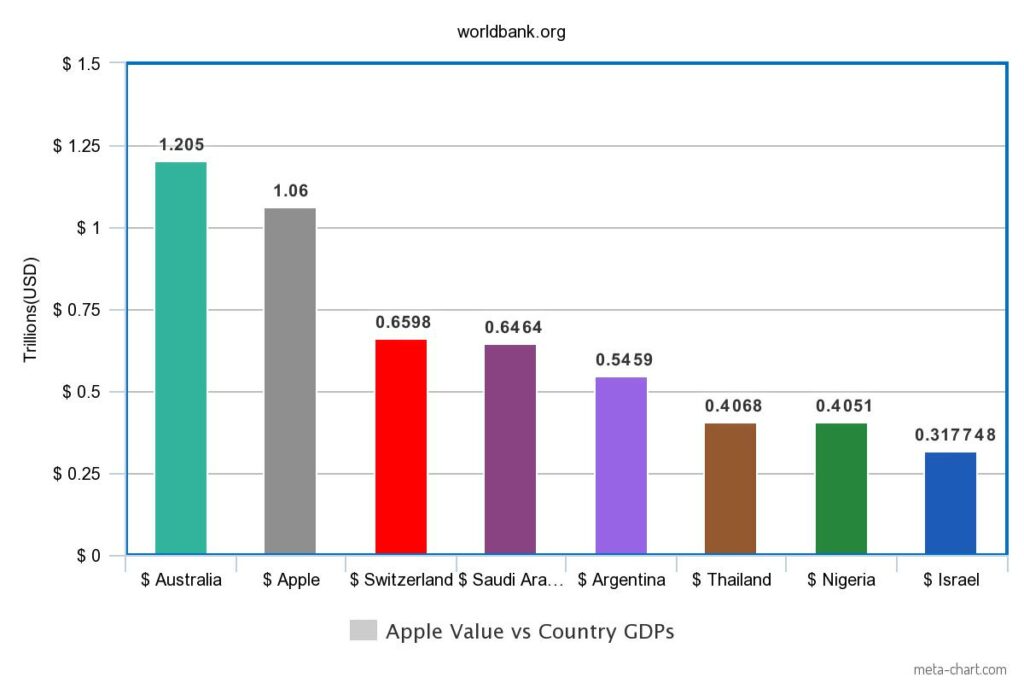

The magnitude of reaching a trillion appears prestigious when compared to the past development of companies. If Apple was a sovereign country, it would be ranked 16th on the 2017 International Monetary Fund’s leaderboard of GDP, above countries like Nigeria, Saudi Arabia, Israel, Thailand, Switzerland, and Argentina. Additionally, if one trillion dollars was to be divided evenly among the 7.5 billion people on Earth, everyone would receive a minimum of $133.33. One trillion also happens to make up 1.25 percent of the world’s total GDP of $80 trillion in 2017.

Apple’s milestone can be interpreted as a premonition to the US government and its rivals as regulations can be imposed. This precautious outlook on implications that Apple may bring with future development is deeply contrasted by one that sees their development as natural and hierarchical as business typically is.

“I still think that we have enough in our American Constitution to control monopolies, and if Apple becomes too big like a monopoly, then we’ll obviously start to break them up with regulations,” Shaw said.

“Today, Apple passed a significant milestone,” said current CEO of Apple Tim Cook. “While we have much to be proud of in this achievement, it’s not the most important measure of our success. Financial returns are simply the result of Apple’s innovation, putting our products and customers first, and always staying true to our values.”

The effects of becoming a large well-established company are perhaps most evident in the Standard Oil Company, as it reached a high valuation around one trillion as well. By buying rival oil refineries and railroads to transport oil, Standard Oil was able to manufacture a powerful monopoly over the oil production, manufacturing, and distribution industries. Seeing their business practices as unethical toward fair trade and business, the U.S. Congress enacted the Sherman Antitrust Act and disbanded the seemingly stable monopoly.

Moreover, Cook’s memo seems to highlight and complement the idea that Apple’s milestone is just business. This theme is based around the ideology that business is predictable and not as significant. Observing how unfazed some analysts and consumers are to the news regarding Apple helps solidify the point that a successful business thriving may not be very surprising.

“Every year they make an iPhone, and every year people want the new shiny thing, so it makes sense [that Apple had become valued at one trillion],” computer science teacher William Gutierrez said.

The fact that two fuel companies, PetroChina and Saudi Aramco, have reached the one trillion mark previously helps confirm that Apple may simply just be next in a chain of companies speculated to pass the benchmark of a trillion dollar market cap. But unlike Apple, these aforementioned companies have unreliable values as PetroChina was worth 2 percent less when adjusted for inflation and Saudi Aramco’s true value is unknown. Amazon has also briefly reached the arbitrary level of a trillion on Sept. 4 before falling under the threshold at 972 billion on Sept. 5.

Another justification for ideology and attitude, could be within the tradition of upgrading and updating that entails the marketing and sales of Apple products, along with other tech companies. For example, Samsung entices consumers by showing the convenience of their products when compared to other brands, while Apple prefers to provide new details.

In retrospect, Apple has reached a pivotal moment in their history, as a international company with 42 years of inventions and innovation in computers and smartphones. And as the first American company to reach a market cap of one trillion, they have garnered the attention of market analysts, consumers, and other companies. In a world of tech super-companies Apple must to find a way to differentiate itself from companies that may challenge the lead that they currently hold.

“Apple transcends the global market – I mean it’s not just an American product, it’s in every household and every country,” Shaw said. “So, it has become a globally dominant force.”